CPI rebound and trade deficit seen

0 Comment(s)

0 Comment(s) Print

Print E-mail Shanghai Daily, April 6, 2012

E-mail Shanghai Daily, April 6, 2012

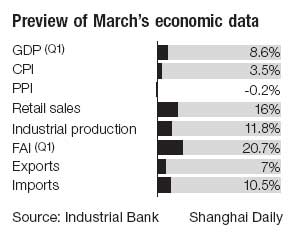

China's inflation may rebound in March while sluggish exports are likely to result in a trade deficit, analysts predicted ahead of China's release of the data next week.

They said that the world's second-largest economy is expected to maintain the current policy stance in the second quarter instead of making any major policy changes.

"The economy is slowing, but the pace of slowdown is better than expected," said Lu Zhengwei, chief economist at Industrial Bank. "The policy stance will be kept neutral because of uncertainties in inflation and exports."

Lu forecast the Consumer Price Index, the main gauge of inflation, will rebound to 3.5 percent in March from the 20-month low of 3.2 percent in February.

"The rebound is mainly due to higher food prices, especially vegetables and aquatic products," Lu said. "Inflationary pressure has not been fully dispelled and the government is unlikely to relax the policy stance abruptly."

China raised the retail prices of gasoline and diesel last month by a larger-than-expected rates, and planned to introduce a graduated power tariff system, stoking fears of more living costs in the future.

Lu said China may cut the reserve requirement ratio in April - the third time in four months - to allow more market liquidity. But it is unlikely to cut interest rate as many had urged.

Tang Jianwei, an economist at Bank of Communications, also projected the CPI to rise to 3.5 percent in March.

China may also post a trade deficit in March after it reported the largest trade gap in a decade in February.

"Due to weak exports, China may deliver a trade deficit again," Industrial Bank's Lu said.

He predicted the trade deficit in March to narrow sharply to US$9 billion from US$31.5 billion in February as "imports are also weakening."

Go to Forum >>0 Comment(s)