The old Chinese saying, "leaking houses are exposed to night-long pouring rain," may well describe the gloom in the Chinese airline industry.

The industry has been on a rough flight path for some time now as high crude prices have been eroding profit margins. With oil prices coming down, the industry thought it had surpassed the rough times only to be confronted by the snowballing economic crisis.

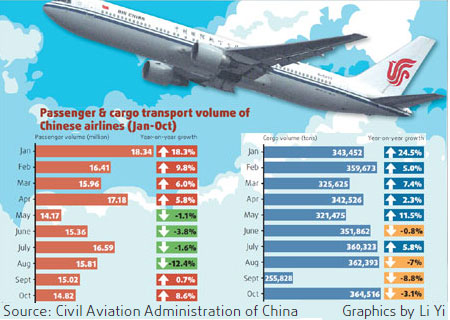

The deteriorating conditions have led to a slump in freight transportation and also forced people to cut back on air travel.

Chinese airlines booked a combined net loss of about 4.2 billion yuan in the last 10 months, said Liu Shaocheng, director, policy and research center, Civil Aviation Administration of China at a recent industry forum.

The industry was also hit by additional challenges like the snowstorm at the beginning of the year, the earthquake in Sichuan province and the high inflation, all of which have impacted traffic.

"The Chinese airline industry will continue to be in the red next year, due to falling demand and reduced pace of renminbi appreciation," said Zhang Qi, an aviation analyst with Orient Securities.

Foreign exchange gains were a major source of profit for Chinese airlines in the early part of the year. The appreciation of the renminbi, to a large extent, offset the surging fuel costs because a large chunk of Chinese airlines' borrowing is in foreign currency. The renminbi appreciated by about 6 percent against the US dollar in the first six months of the year.

The previously buoyant airline industry in the country started showing a negative growth in passenger and cargo transportation from June, the first time since the 2003 SARS epidemic. The fall continued in the following months also.

"The market is expecting the renminbi to appreciate by only 2-3 percent next year. There is even a possibility of depreciation due to the economic slowdown. The problems and difficulties of Chinese airlines will be completely exposed," Zhang said.

The International Air Transport Association (IATA) recently said global air traffic declined for a second consecutive month in October. International passenger traffic fell 1.3 percent over the same period last year, while in September the fall was 2.9 percent.

International air cargo hit its worst patch since 2001 in October this year as traffic declined by 7.9 percent for the fifth consecutive month.

"While the drop in oil prices is a welcome relief, recession is now the biggest threat to airline profitability. The deepening slump in cargo markets is a clear indication that the worst is yet to come," said Giovanni Bisignani, director general and CEO, IATA.

The IATA estimates the industry to lose US$5 billion in 2008 and US$2.5 billion in 2009.

"The outlook is bleak. We are facing the worst revenue environment in the last 50 years," Bisignani said.