Small firms to play greater economic role

0 Comment(s)

0 Comment(s) Print

Print E-mail

CRI, October 17, 2011

E-mail

CRI, October 17, 2011

|

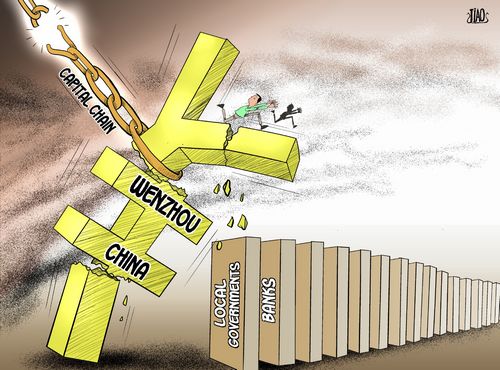

| [By Jiao Haiyang/China.org.cn] |

The State Council, China's cabinet, has unveiled a new set of measures to help cash-starved small businesses, including tax breaks and easier access to bank loans.

The move comes after revelations that a lack of cash has forced a large number of small and medium-sized companies in the city of Wenzhou in east China's Zhejiang Province to shut down this year.

Mike Bastin, Marketing and Management academic at Tsinghua University, believes the government adopted new initiatives because it has become aware of the growing significance of small businesses to China's economy.

"Certainly, it's a good initiative," said Bastin, reiterating the fact that small and medium-sized enterprises generate 50 percent of China's annual tax revenue and contribute 60 percent of its GDP.

"I think the Chinese government realizes that. It's not just the fact that they're cash-starved, the future Chinese economy will depend more and more on the successful growth of small businesses. So I certainly think this will help China's future development."

Meanwhile, China is confronted with the arduous task of taming inflation.

The National Bureau of Statistics announced on Friday that China's consumer price index, a main gauge of inflation, eased slightly to 6.1 percent year-on-year in September from 6.2 percent in August. However, this is still far away from the inflation control target of 4% for this year.

The Tsinghua University expert admitted that small businesses are especially vulnerable to inflation when people stop spending as much as they used to.

"Well, any effect on small businesses is compounded by the fact that they're small, so they really are vulnerable to any cyclical changes in economic indicators. (Inflation) certainly will have an effect, but I think the Chinese economy is sufficiently robust. And what the Chinese government is doing now is one of a continued series of measures to help small businesses. So I think the future will look good for the Chinese economy."

The Wenzhou debt crisis is an extreme case of small and medium-sized private companies struggling to survive the liquidity crunch, which resulted from the country's current macroeconomic control policies that are designed to cool inflation.

Local businessmen have said that the Wenzhou debt crisis was caused by difficulties in borrowing money from banks, as well as soaring production and labor costs.

Wenzhou's 400,000 private firms contribute to more than 90 percent of the city's gross domestic product.

Many of the local firms affected are reportedly original equipment manufacturers, a group of enterprises that Bastin believes needs a breakthrough in terms of creativity.

"Obviously, what we need to see is more innovation and creativity. And we need to see some sort of breakthrough from the small business sector. I think the government can help with education and training and more incentives in that direction."

Go to Forum >>0 Comment(s)