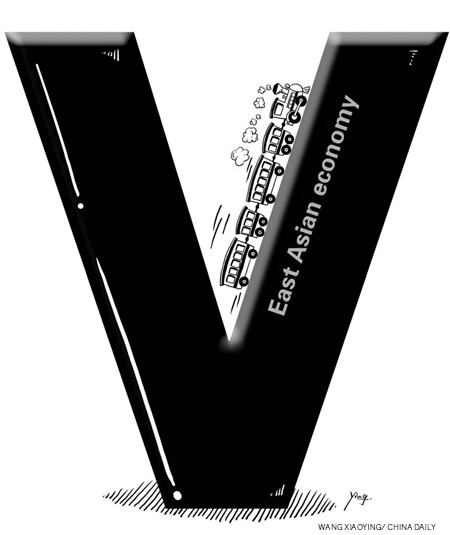

Time to unwind stimulus in East Asia

Emerging East Asia is virtually assured of a V-shaped recovery from last year's economic slump. It is still too early to proclaim that the "V" stands for "victory", though. But with the recovery on track, it is now time to unwind the policy stimulus that has helped power the recovery. Whether or not the recovery is sustainable depends heavily on the timing, policy mix and pace at which the economic stimulus is withdrawn.

As governments begin to unwind their policy stimulus, a "money first" strategy - in which policymakers normalize monetary policy first and consolidate fiscal policy later - is appropriate for most of the emerging East Asian economies. Considering the need to rebalance the region's sources of growth, there is merit in normalizing monetary conditions through a judicious mix of currency revaluation and interest rate adjustments rather than through policy rate hikes alone.

The pace at which economies unwind their stimulus should depend on the speed of recovery as well as evolving risks. So, the authorities must ensure that the private sector is strong enough to take over the slack created by the withdrawal of policy stimulus.

The Chinese authorities are carefully pulling back the stimulus by putting a cap on banks' lending, increasing bank reserve requirements and giving the yuan a bit more flexibility. The aim is to contain inflationary pressures, avoid overheating and keep potential asset bubbles (in the real estate sector) in check while maintaining robust growth.

In the Republic of Korea (ROK), Malaysia, Singapore and Thailand, normalization has already begun, and should continue at what appears to be an appropriate pace. And countries such as Indonesia, the Philippines and Vietnam, which are yet to start unwinding their policy stimulus, may need to start soon. In every case, unwinding policy stimulus should be in step with the speed of the region's recovery, yet always mindful of the risks facing the global economy.

0

0

Go to Forum >>0 Comments