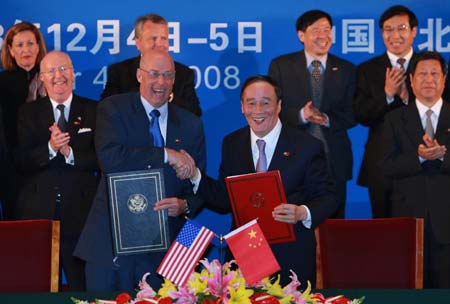

China and the United States concluded a high-profile economic dialogue on Friday morning, with "important consensus" reached on the financial turmoil and critical issues of the two economies.

The two sides agreed to "strengthen financial regulation together" and "enhance the role of developing countries in international financial institutions", Chinese Vice Premier Wang Qishan told reporters after the conclusion of the fifth round of the Sino-US Strategic Economic Dialogue (SED).

US Treasury Secretary Henry Paulson described the talks as "productive" in his closing statement, and said the two sides "had a robust discussion" of the current global financial market turmoil and economic downturn.

Paulson said both nations would be "committed to strengthening the global economy." He added that he welcomed recent measures by the Chinese government to strengthen domestic demand and maintain economic growth.

Both sides said that they would fight trade protectionism, and actively promote a successful Doha round of trade liberalization talks, which hit a deadlock in July on differences between the United States and India over measures to safeguard subsistence farmers in poor countries from a surge in imports.

As a step to support trade amid the current financial crisis, the two sides announced an additional 20 billion US dollars would be churned out from the Export-Import Banks of the two countries to finance trade. The financing would particularly favor "credit-worthy importers in developing countries,", they said.

Paulson said he also discussed with his Chinese counterparts "the importance of domestic-led growth, and the importance of a market-determined currency in promoting balanced growth in China."

According to a fact sheet issued by the US side, the United States recognized that "currency movements would be uneven over shorter periods", but also encouraged China to "continue, and accelerate" the appreciation and flexibility of its currency, the yuan.

The comment was made amid speculation that China was shifting its exchange rate policy to allow the yuan to weaken to help struggling exporters and save jobs - speculation sparked by a weakened yuan against the US dollar this week.

Paulson also said that China has decided to allow foreign banks to trade bonds in China on the same terms as Chinese banks, among other agreements reached to further open up the country's financial sector.

In addition, the two sides agreed to deepen cooperation on product and food safety, and vowed continued efforts to cooperate on energy and environment.

"China look forward to continuing candid and pragmatic talks with the new US administration," Wang said.

(Xinhua News Agency December 5, 2008)