II. The Draft Central and Local Budgets for 2008

The overall requirements for preparing the budgets for 2008 and doing financial work are as follows. We must fully implement the guidelines set out at the Seventeenth National Congress of the CPC and the Central Economic Work Conference. We must hold high the great banner of socialism with Chinese characteristics, take Deng Xiaoping Theory and the important thought of Three Represents as our guide, and thoroughly apply the Scientific Outlook on Development. We must work to increase revenue and reduce expenditures, take all factors into consideration, leave some leeway, maintain a reasonable scale of revenue and expenditures, improve macroeconomic regulation, and concentrate on economic restructuring and changing the pattern of development. We must adjust and improve the structure of expenditures, strictly control regular expenditures, and concentrate on ensuring the wellbeing of the people and improving their lives. We must deepen fiscal and taxation reforms and establish sound fiscal and taxation systems that are conducive to scientific development, focusing on improving the public finance system. We must handle financial matters in accordance with the law and make management more scientific, focusing on improving the performance of public finance management. We must let the function of public finance fully play its role, promote scientific development and social harmony, and make contributions to achieving new successes in building a moderately prosperous society in all respects.

In accordance with the above general requirements and our expectations for economic and social development, the major budgetary targets for 2008 are as follows. Total national revenue is targeted at 5.8486 trillion yuan, 718.197 billion yuan or 14 percent more than in 2007 (same for below). This sum is made up of 3.1622 trillion yuan collected by the central government, an increase of 14 percent, and 2.6864 trillion yuan collected by local governments, an increase of 14 percent. National expenditures should total 6.0786 trillion yuan, a rise of 1.12206 trillion yuan or 22.6 percent. This sum is made up of 1.32052 trillion yuan of expenditures disbursed by the central government, up 15.4 percent, and 4.75808 trillion yuan disbursed by local governments, up 24.8 percent.

Our targets for national revenue and central government revenue are based mainly on the estimates that GDP is expected to grow by 8 percent in 2008; that the rise in the consumer price index should be held to less than 4.8 percent; and that economic indexes directly related to tax revenue such as added value in industry, total fixed asset investment, total volume of imports and exports, and total retail sales of consumer goods are all projected to rise. In addition, overall consideration was given to policy adjustments and other factors that could result in an increase or decrease in revenue. On the one hand, fiscal and taxation policies such as reform of the resource tax and the tax on farmland used for nonagricultural purposes as well as the further implementation of measures to improve revenue collection and management will result in some increase in revenue. On the other hand, the implementation of the new Law on Corporate Income Tax, the effects of lowering the individual income tax rate on the interest from saving accounts, the VAT reform taking place in some cities in the central region, and raising the earnings threshold for the individual income tax all will markedly decrease revenue. In addition, favorable taxation policies to support energy saving and emissions reduction, develop the western region, reinvigorate northeast China and other old industrial bases, bring prosperity to the central region, and stimulate employment will also reduce revenue to varying degrees. Improving macroeconomic regulation, implementing a tight monetary policy in particular, will help ensure sound and rapid economic development. Simultaneously, it will also have an impact on the banking and real estate industries and will lead to a continued slowdown in the growth of some energy-intensive and highly polluting industries. This will bring about some reduction of revenue. The recent disaster resulting from snow and ice storms will reduce revenue. In addition, after several successive years of rapid growth, the revenue base figure was already very high in 2007, and part of the revenue was due to either one-time or exceptional factors, which will be either reduced or nonexistent in 2008. This will result in a corresponding drop in the revenue growth rate. Taking all these factors into account, the projection of 14 percent growth in central government revenue and national revenue is both positive and prudent.

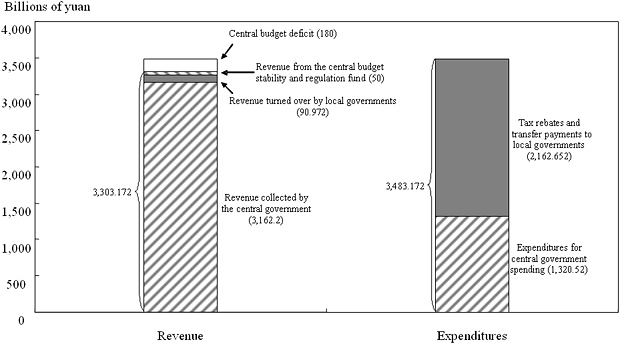

In 2008 we are required to improve macroeconomic regulation, and there will be large spending increases in key areas, so we must keep a firm grip on the scale of revenue and expenditures. Also in 2008, the methods for using surplus revenue will be improved, additional funds made available during budget implementation will be reduced, and we will have to prepare the budget more scientifically and reasonably and be more open to oversight by the NPC. Taking all these factors into consideration, we added 50 billion yuan from the central budget stability and regulation fund to the revenue target in the budget for 2008 on top of the 3.1622 trillion yuan that is to be collected by the central government. Added to the 90.972 billion yuan of revenue to be turned over by local governments, the budgetary revenue target for the central government comes to 3.303172 trillion yuan. Expenditures in the central budget should total 3.483172 trillion yuan, a rise of 17.8 percent. The deficit target for the central budget is 180 billion yuan. The limit for the outstanding balance of government bonds is 5.518585 trillion yuan in the central budget, an increase of 182.032 billion yuan.

Figure 6 Revenue and Expenditures in the Central Budget for 2008

The main targets for revenue in the central budget are as follows: domestic VAT receipts will reach 1.34 trillion yuan, a rise of 15.5 percent; domestic consumption tax receipts will come to 247 billion yuan, an increase of 11.9 percent; VAT and consumption tax receipts from imports will amount to 685.5 billion yuan, up 11.4 percent; VAT and consumption tax rebates for exports will reach 575 billion yuan (this is equivalent to a decrease in revenue by the same amount), a rise of 2 percent; business tax receipts will total 22.5 billion yuan, up 11 percent; corporate income tax receipts will be 643 billion yuan, an increase 13.9 percent; individual income tax receipts will reach 203 billion yuan, a rise of 6.2 percent; stamp tax receipts will come to 194.515 billion yuan, basically the same as 2007; tariff receipts will be 160 billion yuan, up 11.7 percent; and non-tax revenue will reach 143.985 billion yuan, a rise of 5 percent.

The main targets for expenditures in the central budget are as follows: Expenditures for education will total 156.176 billion yuan, an increase of 45.1 percent. Expenditures for science and technology will come to 113.398 billion yuan, up 26 percent in comparable terms. Expenditures to support the social safety net and to stimulate employment will be 276.161 billion yuan, a rise of 24.2 percent in comparable terms. Expenditures for medical and health care will total 83.158 billion yuan, an increase of 25.2 percent. Expenditures for environmental protection will amount to 102.751 billion yuan, up 31.4 percent. Expenditures for agriculture, forestry and water conservancy will total 145.049 billion yuan, an increase of 17.2 percent in comparable terms. Expenditures for industry, commerce and banking (mainly consisting of expenditures for ensuring workplace safety, storing cotton, grain, oil and other important goods and materials, and paying off the debts of policy-supported purchases of grain on credit and the interest on these debts) will be 337.324 billion yuan, a rise of 38.9 percent. Expenditures for national defense will total 409.94 billion yuan, an increase of 17.7 percent. Expenditures for general public services will come to 265.54 billion yuan, an increase of 14.3 percent, including 123.566 billion yuan to pay interest on domestic and foreign debts, up 24.4 percent. Tax rebates and fiscal transfer payments to local governments will total 1.231781 trillion yuan, an increase of 12.8 percent.