REPORT ON THE IMPLEMENTATION OF THE CENTRAL AND LOCAL BUDGETS FOR 2007 AND ON THE DRAFT CENTRAL AND LOCAL BUDGETS FOR 2008

First Session of the Eleventh National People's Congress March 5, 2008

Ministry of Finance

Fellow Deputies,

The Ministry of Finance has been entrusted by the State Council to report on the implementation of the central and local budgets for 2007 and on the draft central and local budgets for 2008 for your deliberation and approval at the First Session of the Eleventh National People's Congress (NPC), and also for comments and suggestions from the members of the National Committee of the Chinese People's Political Consultative Conference (CPPCC).

I. Implementation of the Central and Local Budgets for 2007

Under the correct leadership of the Communist Party of China (CPC), the people of all China's ethnic groups followed the guidance of Deng Xiaoping Theory and the important thought of Three Represents, thoroughly applied the Scientific Outlook on Development, and comprehensively implemented the principles and policies of the central authorities and the decisions and resolutions of the Fifth Session of the Tenth NPC in 2007. As a result, the national economy continued to grow rapidly, the economic structure and performance improved, and people's lives got better. The central and local budgets were also satisfactorily implemented.

National revenue reached 5.130403 trillion yuan, an increase of 1.254383 trillion yuan or 32.4 percent over the figure for 2006 (both here and below) and equaling 116.4 percent of the budgeted figure. This was made up of 2.773899 trillion yuan collected by the central government and 2.356504 trillion yuan collected by local governments. National expenditures amounted to 4.95654 trillion yuan, an increase of 914.267 billion yuan or 22.6 percent and equaling 106.6 percent of the budgeted figure. This was made up of 1.144504 trillion yuan disbursed by the central government and 3.812036 trillion yuan by local governments.

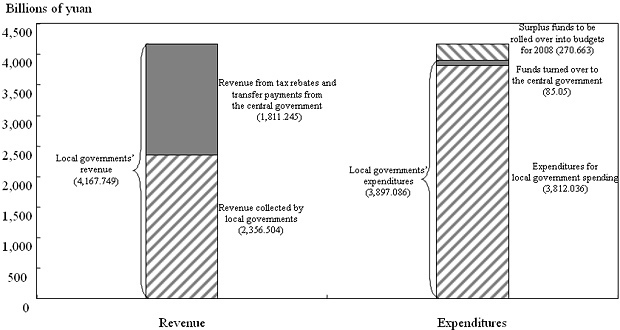

The implementation of the central budget is as follows: Revenue totaled 2.858949 trillion yuan, an increase of 734.56 billion yuan or 34.6 percent and equaling 117.1 percent of the budgeted figure. Revenue included 2.773899 trillion yuan collected by the central government and 85.05 billion yuan turned over by local governments. Expenditures totaled 2.955749 trillion yuan, an increase of 606.464 billion yuan or 25.8 percent and equaling 110 percent of the budgeted figure. Expenditures included 1.144504 trillion yuan disbursed by the central government and 1.811245 trillion yuan paid out as tax rebates and transfer payments to local governments. In addition, 103.2 billion yuan was set aside for the central budget stability and regulation fund for future use. The central government deficit was 200 billion yuan, 45 billion yuan less than the amount approved at the Fifth Session of the Tenth NPC. At the end of 2007, the outstanding balance of government bonds in the central budget totaled 5.207465 trillion yuan, which was under the limit of 5.336553 trillion yuan set for the fiscal year.

Figure 1 Central Government Revenue and Expenditures in 2007

Expenditures in the central budget (including central government spending plus tax rebates and transfer payments to local governments) were as follows: Spending on education totaled 107.635 billion yuan, up 76 percent and equaling 125.4 percent of the budgeted figure. Expenditures for science and technology came to 99.999 billion yuan, an increase of 26 percent and equaling 113.5 percent of the budgeted figure. Expenditures for the social safety net and employment effort came to 230.316 billion yuan, up 13.7 percent and equaling 114.1 percent of the budgeted figure. Expenditures for medical and health care reached 66.431 billion yuan, up 296.8 percent and equaling 212.4 percent of the budgeted figure. Expenditures for environmental protection amounted to 78.21 billion yuan, up 61 percent and equaling 164.7 percent of the budgeted figure. Expenditures for agriculture, forestry and water conservancy totaled 127.449 billion yuan, up 43.9 percent and equaling 106.2 percent of the budgeted figure. Expenditures for industry, commerce and banking (mainly consisting of expenditures for ensuring workplace safety, storing grain, cotton, oil and other important goods and materials, and paying off the debts of policy-supported purchases of grain on credit and the interest on these debts) came to 242.916 billion yuan, up 41 percent and equaling 127.9 percent of the budgeted figure. Expenses for national defense totaled 348.277 billion yuan, up 18.1 percent and equaling 100.3 percent of the budgeted figure. Expenditures for providing general public services totaled 232.301 billion yuan, up 5 percent and equaling 100.4 percent of the budgeted figure. Included in this total is 99.345 billion yuan in interest payments on domestic and foreign debts. Expenditures for tax rebates and fiscal transfer payments to local governments totaled 1.092435 trillion yuan, up 21.2 percent and equaling 108.1 percent of the budgeted figure.

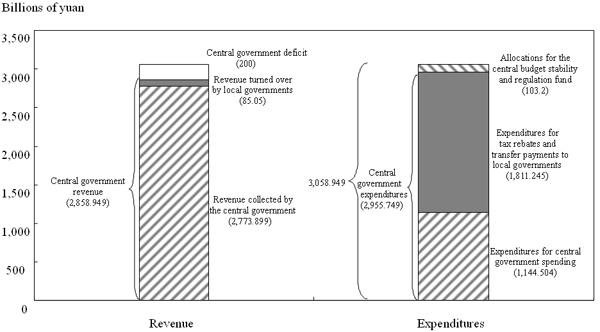

The implementation of local budgets is as follows: Revenue amounted to 4.167749 trillion yuan, an increase of 987.246 billion yuan or 31 percent and equaling 114.9 percent of the budgeted figure. This included 2.356504 trillion yuan collected by local governments and 1.811245 trillion yuan in revenue from tax rebates and transfer payments paid by the central government. Expenditures totaled 3.897086 trillion yuan, an increase of 775.226 billion yuan or 24.8 percent and equaling 107.4 percent of the budgeted figure. Expenditures included 3.812036 trillion yuan spent by local governments and 85.05 billion yuan they turned over to the central government. Transfer payments from the central government accounted for 36.7 percent of local government spending nationwide, and the percentage went up to 54.1 percent in the central and western regions. Revenue exceeded expenditures by 270.663 billion yuan, and this surplus mainly came from the surplus revenue in the central and local budgets that was not spent last year and will be rolled over into local budgets this year. These figures may change when the final accounts are calculated.

Figure 2 Local Governments' Revenue and Expenditures in 2007