China is unlikely to suffer a crisis similar to the financial woes in Vietnam and the possibility of it triggering another Asian turmoil is slim, analysts said.

Moreover, other Asian countries may use their foreign exchange reserves to help Vietnam to tide over the crisis, said Zhuang Jian, senior economist with the Asian Development Bank in Beijing.

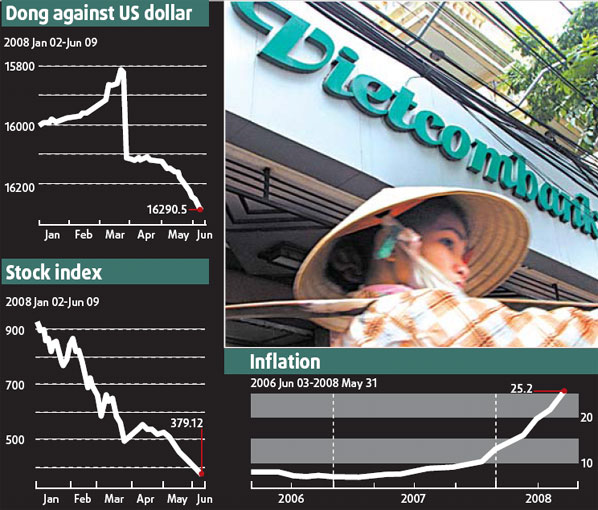

Vietnam's economy, the recent darling of international investors, is sliding into a boom-and-bust cycle as it is battered by double-digit inflation, surging trade deficit, a diving stock market and depreciating currency.

Analysts anticipate the worst-case scenario to be a deadly flight of capital and a balance of payment crisis. But even if that happened, the crisis will not recur in China as the two countries are starkly different in terms of major economic features, said Zhao Xijun, finance professor of the Renmin University of China.

Surging international prices of commodities such as grain and oil have stoked Vietnam's domestic inflation, a problem that China is also suffering. But Vietnam has its own intrinsic economic defects, said Zhao.

In recent years, the Vietnamese government has encouraged foreign investment and exports to boost growth. But it has failed to prevent speculative foreign capital from investing in stocks and real estate, which has led to soaring assets prices. "Unlike China, Vietnam has not clearly defined foreign capital going into the assets market," Zhao said.

As the US economy is believed to have bottomed out and the dollar stabilizes, flight of foreign capital has caused an abrupt assets price tumble.

"It's quite easy for foreign capital to flow out of Vietnam, while in China the costs of capital withdrawal would be much higher," said Sun Lijian, economist with the Fudan University.

The reduced foreign demand as a result of the US economic downturn has dampened Vietnam's exports, undermining its economy.

When the Vietnamese economy showed signs of overheating last year, its policymakers failed to take timely measures to cool it down, said Zhuang. Vietnam started to implement a tightening policy only from the second quarter of this year, compared with China's preemptive tightening since the second half of last year.

The Vietnamese government has now decided to stop many investment projects to cool the economy. The planned investment volume of those projects is about 16 percent of the country's pre-set target for this year, according to local media reports.

The nations in the region have learnt their lesson from the 1997-98 Asian financial crisis, accumulating foreign exchange and reforming the domestic economic structures, significantly reducing their vulnerability to such crises, Zhuang said.

(China Daily June 10, 2008)