Property prices heading for a slump, say experts

|

|

Models dressed in Avatar costumes attract visitors at a housing fair in Taiyuan, Shanxi province. [China Daily] |

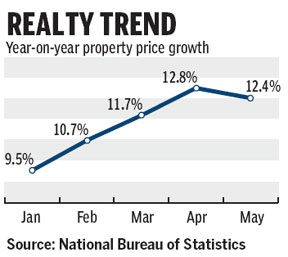

Property prices in China's 70 major cities were up 12.4 percent year-on-year in May, but experts said prices would fall in the following months as the number of transactions decreases.

The growth is lower than the record 12.8 percent year-on-year rise in April, the National Bureau of Statistics said on Thursday.

Property prices in May rose 0.2 percent month-on-month, compared with a 1.4 percent growth in April.

"We expect significant price declines in the next few quarters as investment demand is curtailed and public housing supply increases," said Peng Wensheng, research head of China economy at Barclays Capital.

Homelink Beijing, a real estate brokerage firm, said recently that the price of new apartments in Beijing would slide over the next three months, following falling sales.

According to the China Index Academy, sales in Beijing, Shanghai and Shenzhen, the nation's wealthiest cities, fell as much as 70 percent last month over April's figures.

Most potential buyers are taking a wait-and-see attitude because of policy uncertainties. That is causing the number of property sales to shrink, which in turn puts increasing pressure on property developers.

According to Beijing Real Estate Transaction, only 595 units of commercial apartments were sold in the first week of June, down 58.4 percent on the same period in April.

To boost sales, more leading property developers have begun to offer discounts. On May 6, Guangzhou-based Evergrande Real Estate Group Ltd announced a 15 percent discount on all its projects throughout the country.

To boost sales, more leading property developers have begun to offer discounts. On May 6, Guangzhou-based Evergrande Real Estate Group Ltd announced a 15 percent discount on all its projects throughout the country.

Because it was the first property developer to cut prices, the company's contracted sales value and sold-floor space in May jumped by 8.3 percent and 10.7 percent respectively over the previous month, making it the only listed property developer to witness a month-on-month sales increase in May.

Following Evergrande's example, Shenzhen-based Vanke and Shanghai-based Greenland both began to offer discounts.

"If the government's real estate policies tighten further, China's property prices may drop to the level of early 2009," said Grant Ji, director of Savills (Beijing), a UK-based real estate service provider.

"The government's recent measures to cool the housing market focus on limiting investment demand and increasing the supply of public and low-cost housing. In our view, this represents a shift in housing policy, and more measures - related to taxes, regulations and the public housing framework - will likely be rolled out," Peng said.

0

0

Go to Forum >>0 Comments