Yuan appreciation won't help foreign firms: study

0 Comment(s)

0 Comment(s) Print

Print E-mail China Daily, February 15, 2012

E-mail China Daily, February 15, 2012

While the Chinese currency rate has been a major topic of debate among US lawmakers, who often link it to the trade deficit and manufacturing job losses in the US, one factor has not been discussed much - that appreciation of the yuan would affect non-financial and particularly manufacturing companies listed on the international stock markets.

In a recent study on the impact of the revaluation on companies, two economists - Barry Eichengreen, of the University of California, Berkeley, and Tong Hui, of the International Monetary Fund - argued that yuan appreciation might have an overall negative effect on foreign companies.

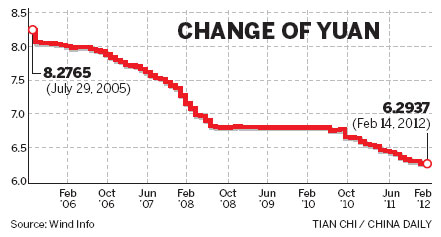

The authors examined the performance of share prices of more than 6,000 manufacturing companies from 44 countries in response to two instances of yuan appreciation announced by the People's Bank of China, in July 2005 and June 2010.

China revalued the yuan by 2.1 percent against the dollar in July 2005, and the yuan has appreciated at least 7 percent against the dollar since June 2010.

"Overall, the message is that across-the-board inferences are misleading," said Tong.

"The long-run effect is difficult to estimate due to compounding factors. But around those two PBOC announcements, the US stock markets experienced negative returns (-0.69 percent around July 21, 2005, and -0.39 percent around June 21, 2010), much lower than other countries," Tong said.

Tong noted that suppliers of materials and components for assembly in China, in contrast, experienced no significant net market-valuation effects at the time of the two PBOC announcements.

The two economists indicated in the report that while yuan appreciation has a positive effect on companies exporting finished goods to China, it has little positive and possibly a negative effect on those providing materials for processing in China. And that latter phenomenon is increasing in the manufacturing industry, in particular, because China is regarded as the "world's factory".

"The impact of renminbi appreciation - actual and prospective - on companies, sectors and countries will be very different depending on their circumstances and the specific nature of their interaction with China," Tong said.

The report indicated that the exchange rate of yuan is not so simple an issue as those who advocate the appreciation contend.

The US Senate passed a bill in October proposing tariffs on goods from any country deemed to be undervaluing its currency. However, the bill was not supported by the House of Representatives or President Barack Obama. The yuan issue has also been frequently raised in the current Republican presidential candidate debates, experts say, mostly because they want to use China as a scapegoat. Republican front-runner Mitt Romney has called China "a currency manipulator".

Yuan appreciation will not solve the unemployment situation in the US and it will not help improve the manufacturing competitiveness, said Eichengreen, co-author of the report.

"China is only one of the many US trade partners, and the level of the currency is just one of many things that affect China-US trade. If you put that together, even a substantial appreciation of China's currency wouldn't have a big aggregate impact on the US," he said.

Go to Forum >>0 Comment(s)