Soros closes hedge fund to outside investors

- By He Shan

0 Comment(s)

0 Comment(s) Print

Print E-mail

China.org.cn, July 27, 2011

E-mail

China.org.cn, July 27, 2011

|

|

|

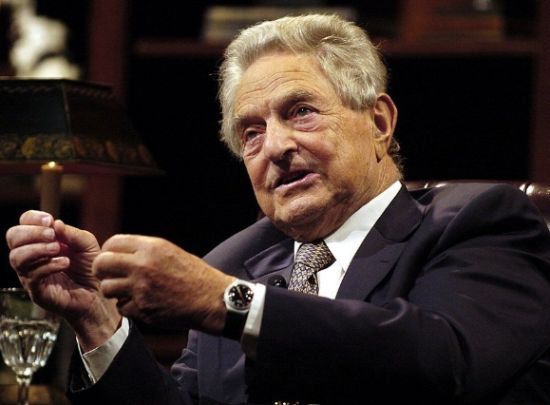

George Soros, the billionaire investor who broke the Bank of England in 1992. |

|

Soros closes hedge fund to outside investors |

索罗斯将结束基金经理生涯 向投资者返还资金 |

| George Soros, the legendary billionaire investor who broke the Bank of England in 1992, will close Soros Fund Management LLC and return capital to the fund's outside investors. | 以成功狙击英国央行而闻名于世的亿万富翁投资者乔治-索罗斯(George Soros)将结束其四十多年的对冲基金经理生涯,他麾下的索罗斯基金管理公司(Soros Fund Management LLC)将向外部投资者返还资金。 |

| Citing new regulations that would require the fund to register with the SEC by March 2012 unless it operates as a family office, Soros' investment firm decided Tuesday to close the fund to outside investors. | 索罗斯之子在致投资者的信中表示,他们作出这一决定的原因在于根据最新的金融监管规定,索罗斯基金必须在2012年3月份以前向美国证券交易委员会(SEC)登记,否则就不能继续为外部投资者管理资产。 |

| "We wish to express our gratitude to those who chose to invest their capital with SFM over the last nearly 40 years," Soros' sons Jonathan and Robert, deputy chairmen of the firm, said in a letter to investors. "We trust that you have felt well rewarded for your decision over time." | 两人在信中表示:“我们希望向那些在过去将近40年时间里将其资本投资到索罗斯基金中的客户们表示感谢。我们相信,从长期来看,这一决定已经为你们带来了良好的回报。” |

| The letter also said chief executive investor Keith Anderson, who took the job in February 2008, will soon leave the company.. | 信件还称,自2008年2月份以来一直担任该基金首席投资官的凯斯-安德森(Keith Anderson)将会离职。 |

| Two people close to the issue said the investment firm is handing back no more than US$1 billion to investors and will thereafter focus solely on managing the assets of Soros and his family. | 两名熟知内情的消息人士透露,索罗斯将在年底以前向外部投资者返还不到10亿美元的资金。该基金将集中致力于仅为索罗斯及其家族管理资产。 |

| Soros said the move will enable him to spend more time on philanthropic and political work, to which he has donated more than US$8 billion over the past 30 years. | 索罗斯此举将使其从一名投机者转变为一位慈善政治家。索罗斯在最近发表的一篇文章中称,在过去30年时间里,他捐赠了80多亿美元资金来促进民主、培育言论自由、改善教育和消灭全球范围内的贫穷现象。 |

China's business press carried the story above on Wednesday.

Go to Forum >>0 Comment(s)