IMF lauds global role played by economy

0 Comment(s)

0 Comment(s) Print

Print E-mail

China Daily, July 22, 2011

E-mail

China Daily, July 22, 2011

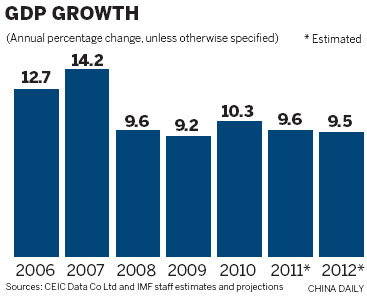

China will continue to drive global economic development with an estimated growth rate of 9.6 percent this year, despite signs of an economic slowdown, the International Monetary Fund (IMF) said in a report issued on Wednesday.

China, however, still faces a number of risks, such as high inflation, a precarious property bubble and a decline in credit quality due to an excessive amount of bank loans, according to the annual IMF report on China.

A key gauge of manufacturing activity showed that the factory sector shrank for the first time in a year in July.

The HSBC Manufacturing Purchasing Managers' Index fell below 50 for the first time since July 2010. Analysts said it signaled a slowdown in growth as a result of tightened monetary policy. When the index is above 50 it signals expansion, when beneath it, contraction.

"Industrial growth is expected to decelerate in the coming months as tightening measures continue to filter through," said Qu Hongbin, chief economist for China and co-head of Asian Economic Research at HSBC.

China's economy grew 9.5 percent in the second quarter, exceeding expectations and easing concerns of a hard landing amid tight monetary policies to curb inflation.

The better-than-expected economic data for the second quarter gave some economists grounds for optimism over the prospects for China's economic growth.

"We raised our 2011 GDP growth forecast to 9.5 percent from 9.4 percent," Sun Chi, an economist at Nomura Securities, said.

According to the IMF, China has increased its sway over the global economy and holds "an important stake for the world in its stability".

The fund's executive board reached these conclusions after some of its members visited China between May 23 and June 9 to collect economic and financial information and hold discussions with officials, such as Vice-Premier Wang Qishan, Minister of Finance Xie Xuren and People's Bank of China Governor Zhou Xiaochuan.

The visit focused on China's macroeconomic outlook, the potential for a property bubble and factors endangering the banking system, said Nigel Chalk, senior adviser at the fund's Asia and Pacific Department, who led the IMF visit to China. He spoke via a conference call before the fund released the report on China.

Chalk said his team noted that a great deal of progress had been made in China in changing the GDP-based growth model while expanding the social safety net.

Inflation will start to "move to a downward trend" toward the end of the year, Chalk said.

He Jianxiong, IMF executive director for China, and Zhang Zhengxin, senior adviser to the executive director, said China's key challenges are to "balance the need for containing inflation, sustaining strong growth, and accelerating the transformation of the growth model.

"The task is complicated by the difficult external environment," He and Zhang said in a statement.

Both He and Zhang took issue with IMF assessments that the yuan is undervalued.

Both argued that the IMF report is based on "the assumption of unchanged policies and a constant exchange rate" and "ignores the trend of exchange rate movement and the far-reaching legally binding rebalancing measures to be implemented in the medium term".

Chalk, however, said that a stronger yuan is necessary for reform and growth. "We do believe that China's currency needs to be stronger," Chalk said.

Reform of the yuan exchange rate is part of a "package of reforms", Chalk said, that will make China's financial sector more market-oriented and better integrated into the global financial system.

Currency appreciation is important in efforts to rebalance the economy, Chalk said.

But he also noted that China's financial reform is a "risky undertaking" and "needs to be managed carefully".

Go to Forum >>0 Comment(s)