Increasing pork prices breed hopes, worries

0 Comment(s)

0 Comment(s) Print

Print E-mail

China Daily, June 23, 2011

E-mail

China Daily, June 23, 2011

|

|

|

Workers process pork at a slaughterhouse in Zibo, Shandong province, on Monday.[China Daily] |

Wang Yugui, a farmer in Zibo, Shandong province, has not seen pork prices this high since he started raising pigs in 2001.

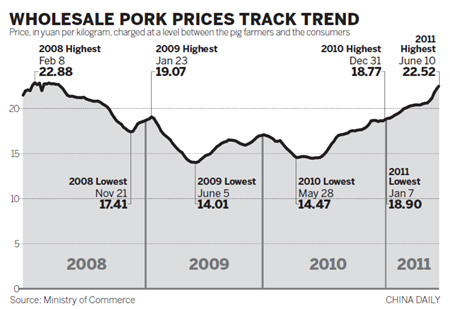

When pork hit a record 18.4 yuan ($2.83) a kilogram this month, nearly twice the March 2010 price, Wang decided to sell the 10 pigs he had that weighed more than 100 kg, the market minimum.

However, 60 of his pigs are still underweight. Like more than 1,000 other pig farmers in Zibo, the 50-year-old must wait and risk missing out on turning a profit.

"I hope all our pigs grow to 100 kg so I can sell them at peak price."

There's no way to speed the fattening-up process, but Wang's luck might just hold. Some experts expect pork prices will keep going up for the rest of the year. Good news for those who raise pigs, not for those who buy pork at the grocery store.

"The price increase is a reflection of the pig growth period," said Zhu Baoliang, deputy director of the economic forecasting department at the State Information Center. "It takes about a year and a half for the price to reach the peak from the bottom.

"The price touched bottom in July and then began to pick up. It will keep going up before the next pigs are fattened in six or eight months."

Li Yongqiang is more patient about selling his pigs. He is 62 and has been farming pigs for 21 years. "If I stock the pigs for one more week, each pig will bring me another 100 yuan."

Li sold more than 400 pigs last Thursday. Then he learned that the price has edged up 0.1 yuan a day since early June. A one-week delay in selling his pigs could bring Li 1 or 1.2 yuan more for each kilogram.

Li keeps about 6,000 pigs in his breeding farm in Dasungezhuang village in Beijing's Shunyi district.

Numbers down

A shortage of stock and rising feed and labor costs are chiefly responsible for the increase in the market price for pigs.

Shandong farmers raised 40 million pigs last year, 1 million of them in Zibo. This year, however, the number of pigs in the city has dropped to about 950,000, said Xue Lequan, deputy director of the city livestock bureau's production division.

Farmers reckon the cost of raising a pig to market is 8 yuan a kg. When the price dropped from 13 yuan in 2009 to 9.6 last year, many growers stopped breeding pigs and sought city jobs.

In Wang's village, 17 families left pig breeding behind last year. Only seven are still in business.

They are raising 1,200 pigs this year, which is 1,700 fewer than last year, Wang Shunlin said. He owns the biggest pigpen in the village, accommodating 600 heads.

Farmers fear disease most. Last winter was warmer than normal, and more bacteria survived. Many sows fell ill and fewer piglets were born. Five of the 10 sows in Wang Yugui's pen failed to get pregnant because of disease, and he lost 40 piglets.

|

|

|

A woman buys pork at a market in Linzi district in Zibo city, Shandong province. The average retail price of pork was 25.46 yuan a kilogram on Wednesday and likely will keep going up this year. [China Daily] |

Food and keepers

"Corn accounts for 60 percent of pig feed" and its price is up 30 percent from April 2008, said Feng Yonghui, chief analyst of Soozhu.com, an online pig market monitoring and analysis service. "It reached a record high in March this year before the price of pigs and pork did."

Li, the Beijing pig farmer, thinks that in the background of inflation, the price of corn is acceptable if it stays below 3 yuan a kg. Still, even if farmers are getting more for their pigs at market, the extra they spend on fodder narrows their profit margin.

Each pig consumes 250 kg of corn in the six months or so from birth to market. Corn, which sold for 1.6 yuan a kg in 2005, now costs 2.3 yuan a kg. It means Wang Yugui spends 12,250 yuan more on corn.

Labor costs are up too, "by at least 20 percent from last year", Feng said. "Migrant workers now earn 2,500 yuan or 3,000 yuan a month and their monthly wage was about 2,000 yuan last year."

And it's not just the wages that are a problem, Li said.

"I now pay the keepers 100 yuan a day, though I paid them 5 yuan a day in the past years. But if I were to offer 100,000 yuan a year, I would still have trouble hiring a breeding technician because few college graduates are willing to work in the hot, dirty pigsties with no breaks."

Swings, stability

Pig farmers said the market is basically self-regulating, which means there can be wide price fluctuations. The central government does maintain a livestock reserve so it can provide more pork when the retail price is very high. It also provides occasional subsidies to farmers, such as one last year when the market price dropped so low.

Wang Yugui received 1,500 yuan, which eased the strain a bit, but he said it made just a small dent in his loss of 10,000 yuan.

Wang Shunlin said, "We farmers prefer a stable price for pigs as we will suffer less loss when the price undergoes a dramatic drop."

Meanwhile, pig production continues at a stable pace. A female pig, called a gilt, reaches maturity at about 8 months, but farmers usually wait two months more before letting her mate because she will produce bigger litters. Gestation takes about 114 days, four months, and once the piglets arrive, the gilt is called a sow. Piglets need six to eight months to reach market weight, Li said.

The farmer will lose money when the price of pigs for slaughter is below 14 yuan a kg, because the cost of raising a pig runs about 1,500 yuan. If the price hits 19.8 yuan a kg, the farmer can profit about 500 yuan on a 100-kg pig.

Advantages of scale

As in most businesses, the bigger producers are better able than small ones to weather price fluctuations and setbacks, such as illness. Xue, at Zibo's livestock bureau, said, "Small farm owners do not have enough money to buy sanitary facilities and they usually cure sick pigs themselves."

Usually, they must sell their market-size pigs before they can buy what they need for the smaller animals. A pen large enough for 100 pigs costs about 300,000 yuan in Wang Yugui's village, and farmers cannot afford to resume the business if they quit. If prices drop year after year, they must sell off their stock, even at a loss.

Large pig farms also are better able to recover from financial losses, so local authorities followed the central government's stipulation to support farms that raise at least 500 pigs. Now, Xue said, more than 100 farms in Zibo keep at least 1,000 pigs.

He thinks there is little room left for the price to increase because millions of pigs will be put up for sale in late August or early September, the busy trading season. Li, the Beijing pig farmer, agrees.

"The price will begin to fall next June when the next pigs are supplied into the market," Li said. "It takes at least one year because many pig farmers slaughtered even their stud boars and sows when they suffered from low prices last June and diseases at the end of last year.

"Small pig farms can do well when the price is increasing," Li said, "but a single loss could drive them to bankruptcy. This is a business of high risk and high reward. Their hearts are broken after suffering from the price fluctuations in the past years."

Li's village had about 100 pig farmers 10 years ago, and now has about 20. Fewer than five of them keep more than 50 sows.

"The price of piglets was 16 yuan a kg at the end of 2010 and it is now 36 yuan, while a piglet weighs about 25 or 30 kg," Li said. "A piglet costs about 1,000 yuan now."

Add the costs of corn and vaccinations, and consider how many piglets will not make it to market. Their death rate is as high as 70 percent because of diseases, he said. "A sow bears twice a year and bears about 13 or 14 piglets when the farmer is lucky. But the farmer starts to profit when a sow bears 15 piglets."

Slaughter slowdown

Pork processors also are feeling the effects of increased costs to farmers and higher market prices.

"It has become difficult to buy grown pigs now," said Zhang Youtang, general manager of Qimeisi Pork, the biggest pork processor in Linzi district. The factory produces 15 tons of pork each day.

"Though pig and pork prices increased, the profit my factory earns dropped by 20 percent because much less pork is produced," Zhang said.

Every morning, seven employees called collectors are sent to villages to find and buy pigs, but most bring back fewer than 20, half of the number last year. And half the usual number are run through the production line, where agile butchers can handle three pigs in one minute.

With fewer pigs to process, butchers are working fewer hours, but at their full pay rate, said Yang Yandong, who is in charge of production in the factory.

Grocery bills

Grocery shoppers have already noticed. Compared with a year ago, the price of pork was up 41.5 percent in May and 45.5 percent in June. On Wednesday, the average price was 25.46 yuan a kg, which was 1.55 yuan a kg higher than on Tuesday.

Analyst Feng Yonghui said to expect the prices of corn and other vegetables to rise as well. "About 70 percent of China's corn is used as feed. The growing demand for pig will further tighten the corn supply."

Feng also noted that about 65 percent of China's meat is pork. If consumers find it too expensive, they "may end up turning to vegetables for alternatives, and that would raise their prices. The flooding in the South could further raise vegetable prices."

It also could raise the consumer price index (CPI), because it's "an important factor in the calculation", said the information center's Zhu. "A price increase of 40 percent could add 1.2 percentage points to the CPI."

China's CPI surged by 5.5 percent in May from a year earlier, with food price contributing about 11.1 percent to the increase, according to National Bureau of Statistics.

![Workers process pork at a slaughterhouse in Zibo, Shandong province, on Monday.[China Daily] Workers process pork at a slaughterhouse in Zibo, Shandong province, on Monday.[China Daily]](http://images.china.cn/attachement/jpg/site1007/20110623/0011111fa1560f6cd9db13.jpg)

![A woman buys pork at a market in Linzi district in Zibo city, Shandong province. The average retail price of pork was 25.46 yuan a kilogram on Wednesday and likely will keep going up this year. [China Daily] A woman buys pork at a market in Linzi district in Zibo city, Shandong province. The average retail price of pork was 25.46 yuan a kilogram on Wednesday and likely will keep going up this year. [China Daily]](http://images.china.cn/attachement/jpg/site1007/20110623/0011111fa1560f6cd9fd14.jpg)

Go to Forum >>0 Comment(s)