China hikes RRR for 5th time in 2011

|

Editor's notes: |

|

On May 12, the People's Bank of China raised reserve requirement hike for the fifth time in 2011. The move, targeted to further curb inflation, orders domestic banks to set aside more money from lending. Effective from May 18, the reserve requirement ratio for banks will rise by 0.5 basis points, bringing RRR for large financial institutions to a record high of 21 percent. The move is expected to freeze about 370 billion yuan in liquidity in the banking market. |

|

Latest news: | ||

|

Bank reserve requirement ratio ups 50 bps China's central bank announced Thursday that it will raise the reserve requirement ratio (RRR) of the country's lenders by 50 basis points from May 18, the fifth such rise this year. [Full article]

Apr. 17, 2011 | Mar. 18, 2011 | Feb. 9, 2011 | Dec. 26, 2010 | Oct. 20, 2010

| ||

|

• 2011 trade surplus may drop to US$100b |

||

|

Experts' opinions: | |

|

|

"The reduction of money supply can help curb inflation. With a 3.25-percent one-year deposit rate and a 5.3-percent inflation rate, we cannot yet rule out the possibility of a rate hike." -- Yao Jingyuan, chief economist of the National Bureau of Statistics |

|

"I think the central bank's move has a lot to do with the consumer price index released Wednesday. There is still significant upward pressure on prices and ample liquidity in the banking sector. The reason that people were surprised about the RRR hike is because they think the reserve requirement ratio is already at a relatively high level... We are tightening liquidity to prevent inflation to go up further, and I think our move is right." -- Tan Yaling, director of the China Forex Investment Research Institute |

|

|

|

"The central bank hikes reserve requirements in an effort to tighten liquidity. Current inflation is not a short-term one, but an imported-type of inflation that will stay for a long period of time. However, the previous RRR hikes haven't shown an obvious effect. The central bank should increase interest rate. Only by doing so, can the central bank bring down commodity prices." -- Yi Xianrong, researcher at the Financial Institute of the Chinese Academy of Social Sciences |

|

"The central bank aims to control banks' lending scale and reduce liquidity pressure through the reserve requirement hike. This round of RRR hike is well within market expectations. After the RRR hike, it's highly unlikely for the central bank to increase interest rates." -- Ye Tan, economics commentator |

|

|

|

"This round of reserve requirement hike is targeted at control liquidity. China's trade surplus has started to pick up, and there is ample liquidity in the open market. Therefore the country's inflation rate remains at a high level."

|

|

"The central bank chose to hike reserve requirements again and again because it want to keep the country's whole-year liquidity at a reasonable level. However, China's liquidity level won't change much in the short term, therefore I think the central bank will probably hike reserve requirements again very soon." -- Zuo Xiaolei, chief economist at Galaxy Securities |

|

|

Performance of Shanghai Composite Index after each hike |

|

|

|

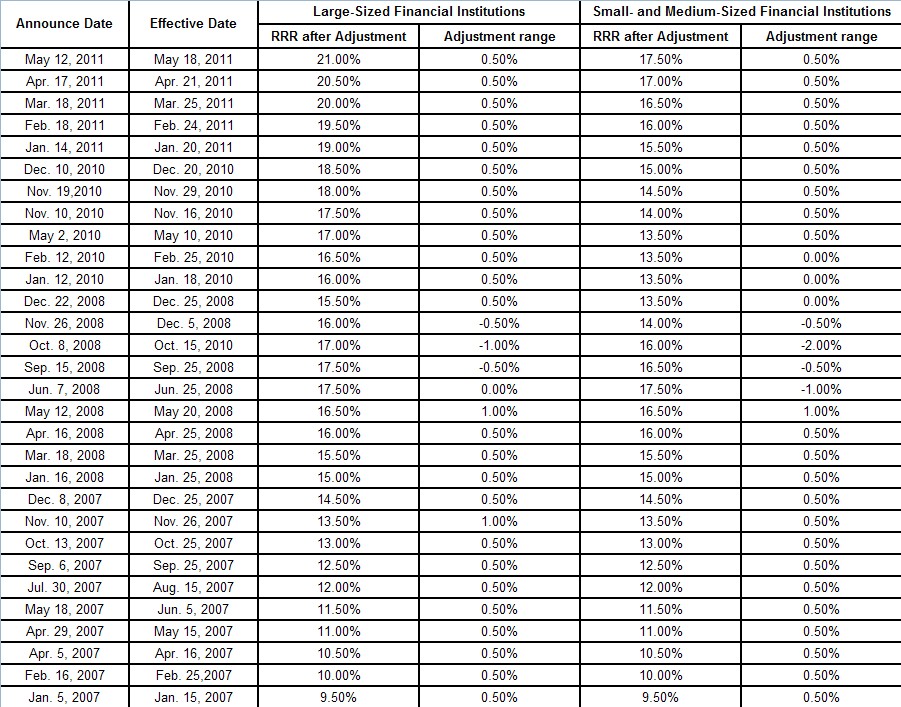

Reserve requirement ratio hikes in recent years |

|

|

0

0

Go to Forum >>0 Comments