China raises key rate for the first time since 2007

China's central bank Tuesday announced a rise of its benchmark one-year lending and deposit rate by 0.25 percentage points effective from Oct. 20, a move widely seen as the government's action against inflationary pressure.

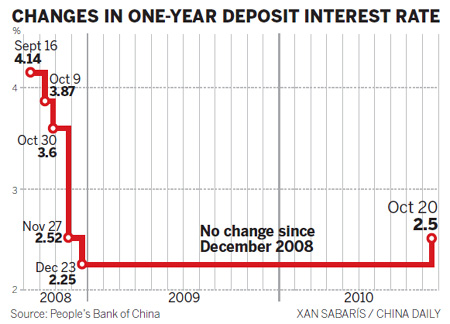

The People's Bank of China (PBOC) said in a statement on its website that the one-year deposit rate will rise from 2.25 percent to 2.50 percent, and the one-year lending rate will increase from 5.31 percent to 5.56 percent.

The rise, the first over the past three years, had not been anticipated and could be related to the impending September statistics and the third quarter statistics, said Jiang Chao, an analyst with Guotai Junan Securities.

The CPI (Consumer Price Index), a key gauge of inflation, may maintain its high level in September, Jiang said.

The rate hikes are the first in three years. The central bank last hiked rates on Dec. 21, 2007.

The benchmark interest rate has been cut four times since the global financial crisis.

Li Daokui, a member of the PBOC's monetary policy committee, said statistics showed China's economy has been bottoming out from the accelerated slump at the beginning of this year, but prices of goods remain at a high level, attracting attention from policy makers.

Further, policy makers have to seek a balance between economic growth, restructuring and stable prices, Li said.

"Judging from the move, worries about soaring prices overwhelmed jitters on economic growth, as is the main reason for the interests rate hike. Negative interests rate (higher CPI increases than deposit interests rate) is also another reason," Li said.

Liu Yuhui, an expert with the Institute of Finance and Banking at the Chinese Academy of Social Sciences, said the interests rate hike this time is related to expectations of inflation as the negative interests rate has continued for seven months.

China has been experiencing hikes in prices of agricultural products, urban services like home rents and catering, Liu said.

"We believed it was caused by soaring labor costs, also related to issue of currencies and soaring living costs in cities," Li said.

Prices of garlic, ginger and sugar have jumped in China's market. Sugar prices in Shanghai stood at 6,000 yuan (900.90 U.S. dollars) per tonne, much higher than 2,700 yuan per tonne seen one year earlier.

China's CPI hit a 22-month high of 3.5 percent in August. The inflation index not only exceeds 2.25 percent on a one-year deposit rate, 2.79 percent on a two-year deposit rate, but also surpasses 3.33 percent of a three-year deposit rate.

Experts believe the interests rate hike works more as an alert, rather than directly reducing negative interests rate.

"The move shows the government's determination to curb negative interests rates and inflation so that businesses and consumers can adjust their investment and consumption accordingly," Liu said.

Just a week ago, the central bank declared it would temporarily raise the reserve requirement ratio of six big lenders to check inflation.

China has raised the bank reserve ratio four times this year and together with the rate hikes, these indicate China is resuming normal monetary policies after the global financial crisis, said Zhang Qizuo, deputy head of China International Economy Society.

China thus becomes a new member to hike interest rates following Australia, Norway, India and Brazil in the global economic downturn, while many economies lowered interests rates, like Russia, South Africa and Hungary.

Some developed economies maintained their low interests rates, such as the United States, the European Union, Japan and Britain.

The interest rate hikes will have limited impacts on commodities markets as 0.25 percentages are not that significant, said Zhou Zhiqiang, head of Xiangyu Futures Research Institute.

But higher interests rates may attract more inflows of speculative "hot money" into China, fueling China's assets prices, Zhou said.

The hike may raise costs for property developers and mortgage home buyers and further cool down the property market in the fourth quarter, said Yang Hongxu, an analyst with Shanghai-based E-house China Research and Development Institute.

Yang expected the move would usher in a new round of interest hikes. The last round of interest hikes began in 2004 and gathered pace in 2007 - six times a year, but the moves only took effect in the fourth quarter of 2007 in cooling down the property market, Yang said.

The anticipated new round of interest rate hikes may influence the property market with its first move, as the home loan policies have been already tightened, Yang said.

China seeks to achieve a growth rate of around 10 percent and about 3 percent inflation in 2010.

0

0

Go to Forum >>0 Comments