9-month low ushers in falling surplus era

China's trade surplus will continue to fall in the coming months after hitting a nine-month low in January amid increased imports in the run-up to the lunar new year holidays and surging commodity prices, economists said.

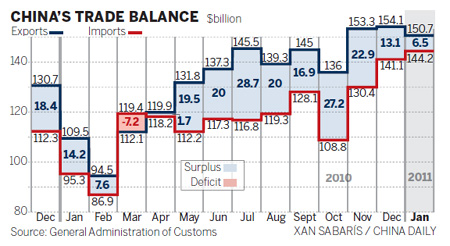

The surplus fell 53.5 percent to $6.46 billion last month, the General Administration of Customs said on its website on Monday. Exports rose 37.7 percent to $150.73 billion from a year earlier while imports climbed 51 percent to $144.27 billion.

The surplus figures came hours after Tokyo confirmed China had surpassed Japan to become the world's second biggest economy.

Economists said the trade situation is challenging as the uncertain economic outlook for major economies, including the United States, Japan and the European Union, poses difficulties for China's exports.

"The trend shows that China's trade surplus is in decline," said Huo Jianguo, director of the Chinese Academy of International Trade and Economic Cooperation, under the Ministry of Commerce.

China's trade surplus has narrowed in recent months as the government has tried to reduce its reliance on exports by boosting imports and domestic consumption after the world economic slowdown.

"As long as China's imports grow faster than exports, China's trade surplus problem will be solved in the next few years," said Huo.

China's annual surplus figure may drop below $100 billion in the next two to three years, he said.

The lower-than-estimated trade surplus is also expected to ease pressure from the US for greater yuan appreciation as a way of addressing the trade imbalance between the two countries.

Analysts said strong consumer demand before the Spring Festival pushed up imports.

"We believe the New Year contributed to increasing imports," said Chang Jian, an analyst from Barclays Capital.

The value of China's foreign trade in January rose 43.9 percent year-on-year to $295.01 billion, the customs said on Monday. Imports and exports rose as businesses accelerated shipments in advance of the two-week holiday period, it said.

Higher commodity prices have also played a big role in boosting the cost of China's imports, as prices for raw materials such as iron ore and copper are at, or close to, record highs.

According to figures from the customs, the price of iron ore, one of China's major imports, surged 66.1 percent to $151.4 per ton last month. The price of imported soya also increased 20.4 percent to $558.1 per ton.

"We expect world commodity prices to remain high and that will push up the cost of China's imports in the coming months," said Lu Zhiming, an analyst from the Bank of Communications.

He estimated China's trade surplus this year will drop to $150 billion, from $183.1 billion last year.

The value of trade between China and the EU, the country's largest trading partner, increased 30.5 percent year-on-year to $45.97 billion in January, according to customs figures, while the value of Sino-US trade increased 39.2 percent year-on-year to $36.87 billion.

China emerged as the leading market for US agricultural exports, according to statistics released by the US Department of Agriculture on Feb 11. But figures from the US Department of Commerce on the same day also showed that the deficit with China rose 20.4 percent last year.

0

0

Go to Forum >>0 Comments