CPI rise may signal bank tightening

April consumer prices rose at the fastest clip in 18 months, which could result in banks' reserve ratio being raised in June and interest rates in the next quarter, analysts said.

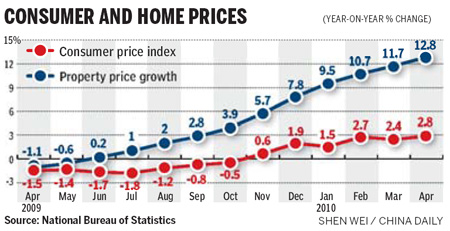

The National Bureau of Statistics (NBS) reported on Tuesday that the consumer price index (CPI), a key gauge of inflation, rose 2.8 percent year on year, 0.4 percentage points higher than in March.

Lu Zhengwei, a senior economist with Fuzhou-based Industrial Bank, said inflation would continue to rise before peaking between August and October, and the central bank may react by raising the interest rates before September.

But the government target of keeping annual inflation within 3 percent "could still be achievable", he said.

NBS data show that consumer prices last month jumped 2.7 percent year on year in urban areas and 3 percent in rural regions. Food items, which have a weightage of about a third in the index, gained 5.9 percent.

"The pressure on prices is still mainly from food items, although it appears to be easing," said Alaistair Chan, associate economist with Moody's Analytics, pointing out that April's food price rise was slower than in March, and also slower than the overall rise in the index.

NBS spokesman Sheng Laiyun cited the weather, particularly the prolonged cold spell, for the price rise and said it would not be much of a factor in May.

Meanwhile, the producer price index (PPI), a measure of inflation at the wholesale level, grew 6.8 percent in April, higher than March by 0.9 percentage point, another factor worrying economists.

Chan said inflation is likely to continue heading north because of the weak base from a year ago and housing prices, which continued to rise despite the recent government intervention, would remain an uncertainty.

Housing prices rose 12.8 percent in April from a year earlier in 70 large cities, higher than in March by 1.1 percentage points.

Prices of new houses rose 15.4 percent year on year, 1.2 percentage points higher than the previous month. Prices in Haikou and Sanya, cities in Hainan province, skyrocketed 64.3 percent 58.2 percent, while they rose 26.1 percent in Wenzhou, Zhejiang province.

It is still early to tell what impact government measures to cool the market will have, although there is "anecdotal evidence" suggesting the asking price for some new housing units has fallen, Chan said.

But Wang Tao, chief economist at UBS in China, predicted that government measures would start to work and be reflected in May data. "Reading the strong property numbers, especially housing prices, the government is not likely to take their feet off the brakes very soon," she said.

0

0

Go to Forum >>0 Comments