Strong trade figures export new optimism

China reported surprisingly good trade figures yesterday, offering fresh evidence that the world's third-largest economy is well on the road to recovery and suggesting global demand is improving.

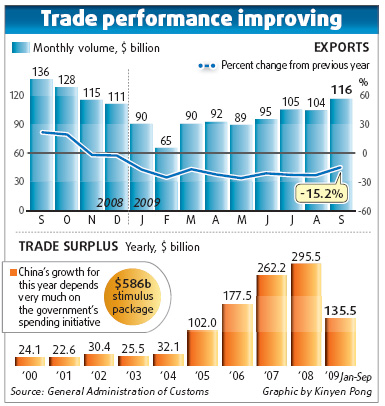

Exports from China fell in September by 15.2 percent compared to the same period last year, which was much better than analysts had expected. Forecasters were braced for a 21 percent fall.

And there was more good news, with imports falling by just 3.5 percent compared to September 2008, far better than the anticipated 15.3 percent decline, reported the General Administration of Customs.

Brian Jackson, an economist with Royal Bank of Canada in Hong Kong, said the slower pace of decline bodes well for China's recovery because growth this year had depended too much on the government's 4 trillion yuan ($586 billion) stimulus package. He said there is now hope that growth can also be encouraged by increased demand.

Indeed, the news was even better than it first appeared because, after adjustments are made taking into account the number of working days each month, exports rose by 6.3 percent compared to August and imports rose by 8.3 percent during the same period, said the General Administration of Customs.

The strong trade performance was beyond the expectations of some analysts who insisted it was not sustainable in the long term.

Analysts said it was too soon to be overly optimistic but they said there will likely be positive growth in exports during the final quarter as manufacturers benefit from both the worldwide economic turnaround and the low benchmark set last year.

"The ease-off in the decline (of exports) is closely connected to the improving economies of the United States and Europe," said Zhang Xiaoji, a researcher and professor with the Development Research Center under the State Council.

While the high unemployment rate is likely to persist for several months and while the consumption confidence index is not encouraging, most American economists believe the US has emerged from the economic recession.

China's purchasing management index (PMI), another indicator of the economic health of the manufacturing sector, rose to 54.3 percent in September, 0.3 percentage points higher than it was in August, according to the China Federation of Logistics and Purchasing. It was the seventh consecutive month that the index had risen above 50 percent.

"Monthly exports during the last quarter are expected to stand at more than $100 billion, and the drop for the whole year could be less than 20 percent," said Zhang.

He predicted that "in November, exports will grow", considering the low reference point. Exports have been falling each month since last November.

Imports in September were worth $103.01 billion. That represented a 17 percent increase on the volume of imports in August, according to the Customs data.

Exports totaled $115.9 billion, up 11.8 percent from August.

Total foreign trade reached $218.94 billion in September, down by 10.1 percent year-on- year.

"The improvements (among both exports and imports) were much larger than expected. The worst is over," said Denise Yam from Morgan Stanley.

The fall in imports was the smallest since last November.

Among the imported material was large volumes of iron ore, copper and aluminum. Imports of iron ore rose to a record 64.6 million metric tons.

"This reflects strong domestic consumption, led by China's economic stimulus package, and is also a positive sign for exports," said Zhang.

But Li Wei, an economist with Standard Chartered, believed the improvements will not be sustained in the next half year because there has not been sufficient growth in domestic investment and consumption.

"The improvement will be slow," he said.

0

0

Comments