China's two biggest home appliance retailers, stung by declining sales as a decade of aggressive expansion succumbs to the economic slowdown, have a major foreign competitor nipping at their heels.

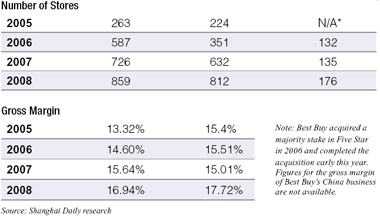

Gome Electrical Appliances Holding and Suning Appliance Co, which operate a combined 2,000 stores across China, have reined in expansion plans and reworked marketing strategies to improve profitability and compete against Best Buy Co, the biggest United States consumer electronics retailer.

"In the face of slower market growth this year, domestic retailers will be taking higher risks if they open new stores," said Guo Yang, a senior analyst at Orient Securities Co. "They will be seeking bigger profit margins instead of the benefits of economies of scale."

China's home appliance and consumer electronics product market is expected to generate revenue of 792 billion yuan (US$116 billion) this year. Gome and Suning account for about an eighth of total sales.

Best Buy is seeking a bigger slice of the pie. It opened its first store in China in 2006 and, after a slow start, has carved out its niche and is seeking to replicate it across the country.

"Developing the China market is not about a race for expansion," said Robert Willet, chief executive officer at Best Buy International. "We want to become the No. 1 choice for customers, which we believe can help raise our market share."

Still, expansion is on the cards. Best Buy, which now operates six self-branded stores in China, completed the acquisition of Jiangsu Five Star Appliance Co earlier this year. Five Star has 170 stores, mainly in eastern China.

More stores to open

Willet announced last month that Best Buy would open up to 12 new stores this year, including some under the Five Star brand, and is forecasting the number may rise to several hundred in the next 10 years.

Gome and Suning have felt the sting of slower consumer spending among tougher economic times. Same-store sales at Suning declined 11.98 percent in the first quarter. Gome did not reveal its figures but BOC International (China) Ltd estimated same-store sales at Gome were flat in 2008. Both retailers have scaled back aggressive expansion plans in favor of focusing on improved profit margins.

Gome said its gross margin, as a proportion of revenue, was about 17 percent last year. Suning reported a similar ratio for the first quarter. By contrast, Best Buy's margin in the fiscal fourth quarter ended February rose to 24.6 percent from 23.7 percent a year earlier.

Gome and Suning have adopted a strategy of focusing more heavily on higher-margin products and the prime segment of computers, consumer electronics and home appliances.

The retailers also are seeking to boost sales by sprucing up their shopping environments and providing enhanced after-sales service.

As part of this new thrust, Gome opened a new flagship store in Beijing last month. It covers 20,000 square meters and has four times more products on display than the average shop.

About 40 percent of the showroom is devoted to computers, consumer electronics and appliances, and the megastore also provides areas for product demonstrations.

"Domestic players with stores of similar layout, products and pricing are engaged in cut-throat competition," said Chen Xiao, president of Gome. "So we are taking a page from foreign retailers and introducing higher-margin goods and our own brand products to set ourselves apart and increase our profitability."

Gome's strategy highlights a developing trend among Chinese retailers, said Lin Yang, an analyst with Dongxing Securities Co. Domestic retailers, who once opposed the entry of foreign competition in the market, are now trying to emulate overseas counterparts well versed in the art of separating a consumer from his money.

Different target market

Best Buy, the chief foreign-owned rival in China, entered the market with a different strategy from its domestic rivals. While they waged price wars for the bargain shopper, the US multinational company targeted its product line at middle to higher-end consumers.

Best Buy stocked its own brands, including Magnolia, Geek Squad and Insignia. It also offered extended warranties, at an additional cost of up to 20 percent of the product's price, and provided large demo areas where consumers can see for themselves just how products work.

"I like shopping at Best Buy because I trust the products it sells and I can get better after-sales service," said Rachel Xu, a white collar in a Shanghai multinational firm. "I don't care if it costs me 10 percent more. What difference does 100 yuan make?"

Consumer electronics contributed 41 percent of Best Buy's revenue in 2008 while traditional appliances accounted for only 6 percent. The remainder comprised home office products, entertainment and services.

A Suning spokesman said his company is starting to provide demo areas in its stores but that's proven hard to do with some traditional home appliances such as air-conditioners, refrigerators and washing machines.

But the stores are having comparatively more success, he said, with demo zones for netbooks, which Suning is trying to promote among other higher profit margin products.

Gome said earlier that up to 100 poorly performing stores will be closed and a similar number of new stores will be opened to keep net outlets at 1,300.

The new megastore launched in Beijing will be expanded if a three-month trial period proves successful. The store attracted 500,000 customers in the first three days and had sales of more than 100 million yuan.

"It is the first time we've tried the new business model," said He Yangqing, a Gome spokesman.

"We are aiming to attract more customers by providing a better shopping experience."

Computer sales surge

Suning now devotes about 30 percent of its stores to consumer electronics and electrical appliances, positioning them near entrances to catch the attention of customers walking in.

The growth in computer sales alone has jumped 30 percent, the Suning spokesman said.

Suning is also renovating stores. It opened a new ultra-modern outlet in Wuxi, near Shanghai, last month. The lighting, product display, elevators and interior decoration will be used as a standard for other shops.

"Standardized stores play a key role in boosting customer satisfaction and lifting same-store sales," said Zhang Jindong, chairman of Suning.

"These standards can also help domestic retailers go abroad and compete with international players such as Wal-Mart, IKEA and B&Q, which have built their success on a standardized model," said Cheng Zhiming, a professor at the business school of Nanjing University.

Still, domestic retailers have a long way to go in replicating the high standards of environment, after-sales service, customer service, delivery and installation offered by foreign retailers, officials at Gome and Suning said.

Gome shares have been suspended from trading on the Hong Kong Stock Exchange since November 24 after former chairman Huang Guangyu was detained on suspected market manipulation.

Shenzhen-listed Suning has shed 18.48 percent to 14.60 yuan this year, against a 58.43 percent rise in the Shenzhen Composite Index during the same period.

(Shanghai Daily May 25, 2009)