Chinese citizens are now more willing to spend rather than save, according to a first-quarter survey by the country's central bank. They have also shown a better willingness to invest, including in the stock market, despite the sluggish market conditions.

|

| Survey hints at tendency to spend more [China Daily] |

The survey was done on 20,000 people in late February. Around 64.5 percent of those surveyed said interest rates on deposits were too low.

The People's Bank of China, or the central bank, had trimmed interest rates continually since September last year to lower the cost of capital in an effort to beat the global financial crisis.

Nearly 30 percent of those surveyed said it was better to increase spending rather than save, up 3.5 percentage points from the previous quarter, but still 7.3 percentage points lower than the first quarter of 2008. This indicates that China faces a challenge in stimulating domestic demand even as exports have continued to weaken, analysts said. In February, exports fell 25.7 percent year-on-year, according to Customs figures.

Around 13.8 percent of the respondents said they thought it was a good time to buy stocks, 5.1 percentage points higher than the previous quarter, marking the second consecutive quarter when the proportion has risen.

A large part of China's 4-trillion-yuan stimulus package, released last November, will be earmarked for livelihood-related areas such as health, as the country tries to encourage people to spend more than save. However, as people's incomes are expected to drop amid the economic slowdown, they are still not in a mood to spend.

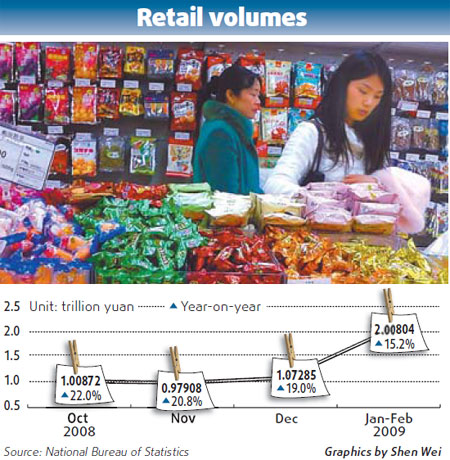

The country's retail sales too slowed slightly in the first two months of the year, rising by 15.2 percent year-on-year, the National Bureau of Statistics said yesterday. It was 5 percentage points lower than the same period last year. Retail sales increased by 21.6 percent for the whole of 2008.

"The country's retail sales may drop in the coming months as the economy weakens and people expect less incomes," said Dong Xian'an, economist, Southwest Securities.

"The drop in exports is leaving a large productive surplus, and if this is not absorbed with domestic demand, unemployment will rise, with possibly devastating consequences," warned Alaistair Chan, economist, Moody's Economy.com.

(China Daily March 13, 2009)