The insurance regulator said yesterday it has received applications from the country's four major banks to invest in insurance companies and is now working on the related rules with the banking regulator.

"We have received applications from Industrial and Commercial Bank of China, China Construction Bank, Bank of Communications and Bank of Beijing to buy stakes in insurers," Yuan Li, spokesman for the China Insurance Regulatory Commission, said at a quarterly briefing in Beijing, adding that the regulator will submit these to the State Council after consideration.

Construction Bank, Bank of Communications and Bank of Beijing to buy stakes in insurers," Yuan Li, spokesman for the China Insurance Regulatory Commission, said at a quarterly briefing in Beijing, adding that the regulator will submit these to the State Council after consideration.

Yuan also said that China Insurance Protection Fund Company would be set up after completing the legal process. And the fund would transfer its 30.55 percent stake in New China Life Insurance at the right time.

"The preparation work is going smoothly, and the regulator is revising the management rules on the insurance protection fund," said Yuan.

Industry statistics show that by the end of last year, the scale of the fund had exceeded 10 billion yuan. In August 2007, the fund acquired 366.65 million shares of New China Life Insurance for 2.2 billion yuan, becoming the insurer's largest shareholder.

Meanwhile, to boost insurers' investment return, especially under a sluggish stock market, the regulator has cautiously allowed insurers to diversify their investment portfolios.

"We will gradually widen the pilot program for insurance companies' investment in infrastructure projects and further expand their overseas investment," Yuan said.

He added that the regulator's capital operating department is now working on the management rules for insurers' investment in infrastructure projects, but he declined to reveal the details.

Sources said earlier this month that authorities might allow some insurers to invest up to 8 percent of their assets in infrastructure projects so they can diversify out of shares and bonds.

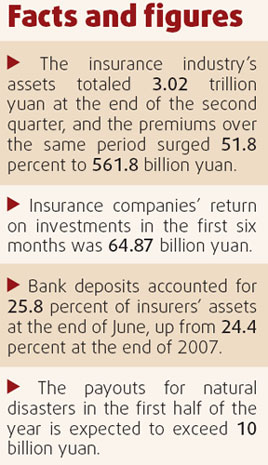

Given the industry's more than 3 trillion yuan total assets, there might be 240 billion yuan flowing into the infrastructure sector.

"For most insurance companies, around 80 percent of premiums still went to bonds and bank deposits, which could hardly ensure a satisfactory investment return," said a head of a joint venture insurer's investment department. "Since infrastructure investment could bring in steady income in the long term, it is a perfect match for insurers' assets."