| Home / Statistics | Tools: Save | Print | E-mail | Most Read |

| Mainland Firms Gain Little from Sourcing Wave |

| Adjust font size: |

By David Lee Global companies have been sourcing from China for decades. From the last decade, however, a new wave of China sourcing, focusing on buying components from China or outsourcing production altogether to Chinese companies, has been catching on.

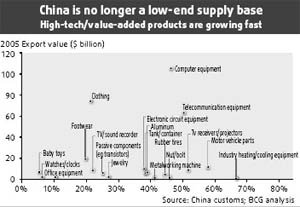

Today, high value-added parts and products such as telecommunications equipment and automotive parts are replacing the traditional made-in-China garments and footwear as some of the fastest growing export segments. Lured by the potential savings, global firms have been rushing to China to set up sourcing offices to take advantage of this low-cost supply base. This wave of "China sourcing" has driven Chinese exports to grow at three times the rate of its red-hot economy ever since China entered the World Trade Organization (WTO) in 2001. Much has been said about the benefits China sourcing brings to global companies. But let's turn our focus to the Chinese supply base to see how much Chinese firms have benefited from the phenomenon. Findings from a recent Boston Consulting Group study on global companies with China sourcing offices indicated that home-grown Chinese companies are not always benefiting from the surge of China sourcing as much as expected, especially in highly competitive industry segments. For many, dealings with local companies are not only difficult because of different cultural and business norms, but there are numerous other concerns involved, such as quality, reliability, service and management capabilities. As a result, global players are often reluctant to source from local companies and would rather work with non-mainland companies operating in China. The study shows that local companies on average only account for slightly more than a third of the spending of China sourcing offices surveyed. Most of the sourcing spend of these companies is going to non-mainland firms Chinese subsidiaries or joint ventures of global suppliers. Of these, Asian companies seem to be benefiting the most as they account for over 40 percent of the sourcing spend. So why are Asian suppliers, particularly those from Taiwan, Hong Kong and Southeast Asia, operating on the mainland so attractive to global buyers? Many attribute their success to these firms' ability to combine a "West-friendly" management style with effective leverage of the low-cost manufacturing environment on the mainland. They are often savvier in dealing with foreign companies and better equipped to understand global customers' requirements. Their Asian roots also serve them well by helping them to adapt to the mainland business environment much easier than global suppliers operating in China. But despite operating in China's low-cost environment, many global suppliers are not necessarily low-cost producers, given the high overheads they have to bear. Also, many of their China operations are under global pricing agreements with their customers, so they are not always willing or able to pass along their savings in China to customers. On the other hand, Asian suppliers are competing against mainland suppliers not on cost, but on services. Asian suppliers are not necessarily as cost-competitive as their local rivals, but their performance in quality, reliability and services often far exceeds their peers. By emphasizing quality and services, and in effect lowering the risk for global companies to source, these suppliers are able to differentiate themselves and create room to compete effectively against low-cost producers on the Chinese mainland. Note: the author is a principal at the Beijing office of Boston Consulting Group (China Daily March 28, 2007) |

| Tools: Save | Print | E-mail | Most Read |

|

| Related Stories |

|